Written by Anneri Fourie | Crises Control Executive

A branch manager receives a call early on a weekday morning. A nearby building incident has forced an evacuation, systems are partially unavailable, and staff are unsure whether to open as normal. The head office is aware something is happening, but no clear instruction has been issued yet. Some teams are waiting. Others are acting on assumptions. Customers are already asking questions.

This is where emergency response planning for banks is tested. Not during scheduled exercises or board reviews, but in moments where information is incomplete, pressure is high, and decisions need to be made quickly without creating further risk.

Most banks have response plans in place. The real issue is whether those plans work under real conditions, across locations, with the right people making the right decisions at the right time.

This article explains why emergency response planning often breaks down in financial institutions, what effective response frameworks look like in practice, and how banks can improve readiness without creating more complexity or process overhead.

What emergency response planning for banks actually means

Emergency response planning for banks is the structured way a financial institution prepares for, manages, and stabilises incidents that threaten people, operations, assets, or regulatory obligations.

In practical terms, it defines:

- How incidents are identified and assessed

- Who has authority to act

- What actions are taken first

- How communication flows internally

- How decisions and actions are recorded

This is different from long-term recovery or risk management. Emergency response focuses on the first hours and days of disruption, where confusion and delay cause the most damage.

When response planning is weak, banks experience slow decision-making, inconsistent messaging, and gaps in accountability. When it works, staff know what to do, leaders stay informed, and regulators see evidence of control.

Why emergency response planning for banks is especially difficult

Banks face a set of pressures that make emergency response planning harder than many other sectors.

Complexity across branches and regions

Banks rarely operate from a single location. Branches, offices, data centres, and third-party providers are spread across regions, each with different risks and constraints.

An incident affecting one site can quickly affect others. A response plan that assumes a single point of control or identical local conditions often fails once decisions need to be tailored by location.

Regulatory expectations under pressure

Financial regulators expect banks to remain in control during disruption. That means clear decisions, documented actions, and traceable communication.

Plans that rely on informal calls, email chains, or undocumented judgement leave gaps that are hard to justify later. During audits or post-incident reviews, the absence of evidence becomes a risk in itself.

Human behaviour during real incidents

Plans are written in calm conditions. Incidents are handled by people who may be stressed, interrupted, or missing key information.

Staff may be unavailable, roles may have changed, or local teams may interpret guidance differently. Remote working has increased this challenge. A plan that assumes perfect execution does not reflect how banks operate during disruption.

Crisis management vs emergency management in banks

Many banks struggle to separate crisis management from emergency management, even though they serve different purposes.

Emergency management focuses on immediate control. It answers questions such as:

- Who needs to act now?

- How do we protect staff and customers?

- What instructions must be issued immediately?

Crisis management operates at a wider level. It deals with:

- Strategic decision-making

- Regulatory and external communication

- Reputational and financial impact

When these two are blended into a single process, response often slows. Senior leaders become involved in operational detail, while frontline teams wait for approval.

An effective incident management framework for financial institutions allows emergency actions to proceed quickly, while senior leaders focus on broader oversight and escalation when needed.

Which is the first step in response planning for financial institutions?

The first step in response planning for financial institutions is defining decision authority.

Many banks assume this is already clear. In practice, uncertainty around who can declare an incident, activate communication, or stand down operations causes hesitation at critical moments.

Before documenting actions or investing in tools, banks should clearly establish:

- Who can formally declare an incident

- Who can trigger staff communications

- How authority shifts between local and central teams

This clarity reduces delays, avoids duplicated effort, and prevents reliance on individuals who may be unavailable during an incident.

What are the elements of an emergency response plan in banking?

While every institution is different, effective emergency response planning for banks consistently includes the following elements.

Incident identification and classification

Staff need a shared understanding of what constitutes an incident and how severity is assessed. Without this, teams either escalate too late or treat minor issues as major events.

Clear criteria help frontline staff act with confidence rather than second-guessing whether a situation warrants escalation.

Role-based response actions

Plans should define actions by role rather than by named individuals. This allows for absences, shift changes, and staff turnover.

Each role should include:

- Clear responsibilities

- Initial actions to take

- Escalation points and handover expectations

Response failures often occur during handovers between teams or shifts. Clear role ownership reduces this risk.

Communication workflows

Emergency communication systems for banks must support fast, targeted, two-way communication. Email alone is unreliable during incidents, especially when systems are disrupted or staff are mobile.

Plans should clearly define:

- Who communicates with whom

- Which channels are used

- How receipt and acknowledgement are confirmed

Two-way communication allows teams to confirm safety, report issues, and ask for clarification.

Coordination across locations

A message that makes sense for head office may not apply to every branch. Banks need the ability to tailor instructions based on location, risk exposure, and operational status.

Location-aware communication reduces confusion and prevents unnecessary disruption.

Logging and evidence

Banks are expected to demonstrate what decisions were made, when, and by whom. Relying on manual note-taking during incidents leads to gaps and inconsistencies.

Response plans should ensure actions and communications are captured as part of the response process, not added afterwards.

Common mistakes in banking emergency response planning

Even well-prepared banks often fall into the same traps.

Over-documentation without usability

Lengthy documents stored on shared drives are difficult to use during an incident. Staff do not have time to search through hundreds of pages while managing real-world disruption.

Breaking plans into clear, actionable steps improves usability under pressure.

Assuming systems will always be available

Many plans assume access to corporate networks, email, or collaboration tools. Incidents often involve partial or total loss of these systems.

Cloud-based access and mobile-first design allow response to continue even when primary systems are unavailable.

Treating communication as one-way

Broadcast alerts do not confirm whether staff received or understood instructions. Two-way communication allows responders to acknowledge messages, request help, or flag issues.

This is especially important for duty of care and staff safety.

Manual vs digital response frameworks

Some banks still rely heavily on manual processes such as printed plans, spreadsheets, and informal call trees.

These approaches are familiar but struggle under scale. Updates are slow, version control is weak, and audit evidence is fragmented across emails and notes.

Digital platforms support:

- Centralised, up-to-date response plans

- Role-based task assignment

- Real-time visibility of response progress

- Automatic logging for review and compliance

The choice is not between manual and digital for its own sake, but between static information and operational control.

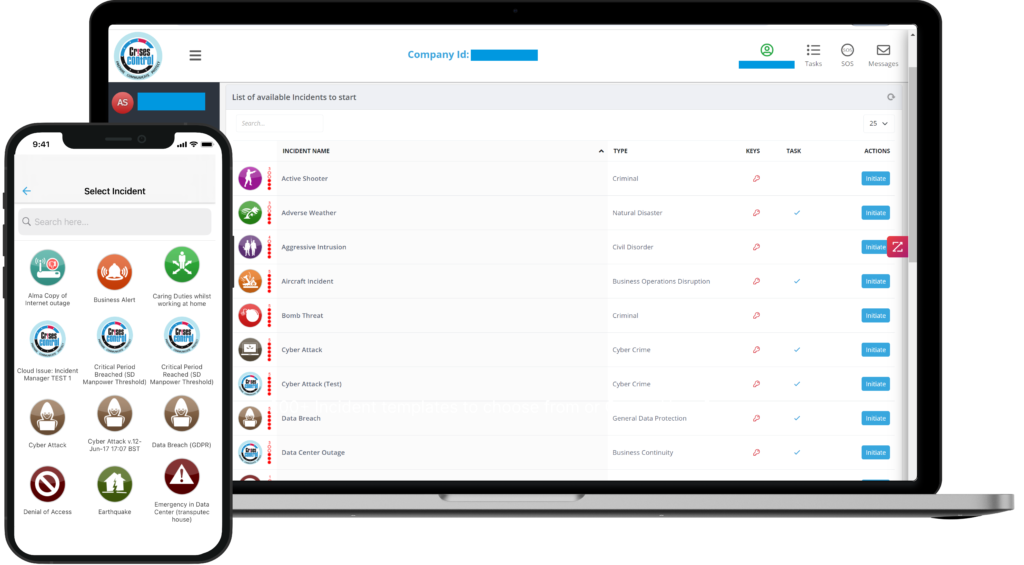

Interested in our Incident Management Software?

Flexible Incident Management Software to keep you connected and in control.

The role of emergency communication systems for banks

Communication breakdowns are a common cause of response failure. Effective emergency communication systems for banks enable:

- Fast delivery across multiple channels

- Location-based targeting for branch networks

- Two-way acknowledgement and SOS functionality

- Secure access aligned with data protection requirements

These capabilities allow plans to be executed, not just documented.

Supporting compliance without slowing response

Banks operate under a range of regulatory expectations, from operational resilience to data protection. Emergency response planning must balance speed with accountability.

Automated logging, controlled access, and exportable reports reduce the burden on teams after incidents. More importantly, they allow responders to focus on managing the situation rather than documenting it manually.

Compliance should be a result of good response, not a separate activity.

How Crises Control supports practical response planning

Crises Control supports emergency response planning for banks by turning static plans into practical workflows. Banks use the platform to:

- Digitise crisis and continuity plans

- Assign role-based tasks during incidents

- Communicate reliably across channels

- Maintain access during system disruption

- Capture evidence automatically for review

This approach reflects how banks operate during real incidents, without adding unnecessary complexity.

Strengthening response planning over time

Emergency response planning is not a one-off task. Banks that improve consistently treat response as an operational capability rather than a compliance document.

Practical improvement steps include:

- Reviewing decision authority after incidents

- Updating roles as teams and structures change

- Assessing communication effectiveness

- Using incident data to refine plans

This continuous approach builds confidence across the organisation.

Final thoughts

Emergency response planning for banks brings together people, process, technology, and regulation. When done well, it reduces disruption, protects staff, and supports regulatory confidence. When it falls short, the consequences are felt quickly and often publicly.

Banks that focus on clear decision-making, practical frameworks, and reliable communication are better prepared to manage disruption without losing control.

If you are reviewing your current approach and want to understand how digital response frameworks support real banking operations, speak to Crises Control.

Request a FREE Demo