Written by Anneri Fourie | Crises Control Executive

When a cyberattack hits or operational systems fail, confusion can spread faster than the incident itself. Teams scramble for information, stakeholders demand updates, and regulators expect evidence of action. For financial institutions, the stakes are high. Delays, miscommunication, or missed steps can result in financial loss, regulatory penalties, and reputational damage.

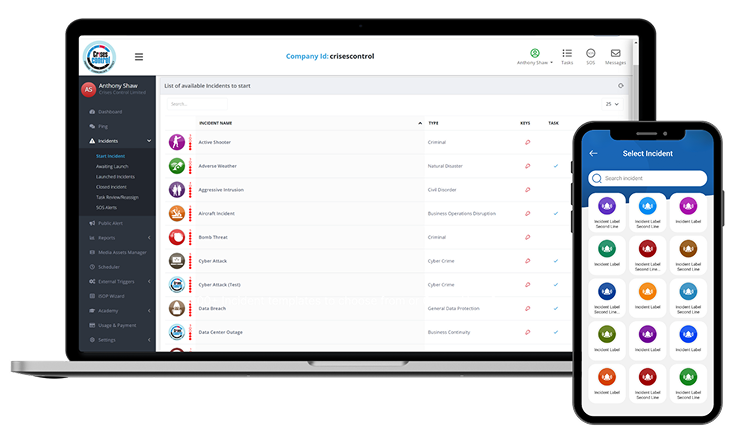

Incident management software provides a solution. It allows banks and financial organisations to coordinate their response teams efficiently, streamline decision-making, and maintain control during high-pressure situations. Crises Control’s Incident Manager is designed specifically for financial institutions to manage cyber and operational incidents with clarity and speed.

This article explores the challenges banks face during crises, how incident management software addresses them.

Why Coordinating Response Teams Is a Challenge

During a major incident, whether a cyber breach or an operational outage, several problems often arise:

- Fragmented communication: Teams rely on multiple channels such as emails, phone calls, or chat apps, creating delays and missed information.

- Unclear roles and responsibilities: When everyone is working off different instructions, tasks can be duplicated or missed entirely.

- Difficulty tracking progress: Without a central view, leadership struggles to understand what actions have been taken and what remains to be done.

- Regulatory scrutiny: Financial institutions must document their response to meet FCA, PRA, SEC, and FINRA standards.

These issues increase stress and reduce the efficiency of incident response. Incident management software addresses these problems by centralising coordination and ensuring that teams can act quickly and accurately.

What Is Incident Management Software?

Incident Management software is a platform that allows organisations to plan, execute, and monitor responses to operational and cyber incidents. It provides a single source of truth, connecting all teams involved in a crisis and giving leadership real-time visibility into progress.

For financial institutions, the benefits include:

- Structured workflows that guide response teams step by step.

- Role-based access to ensure each team member knows their tasks.

- Audit trails to provide regulators with evidence of actions taken.

By centralising incident response, institutions can reduce confusion, maintain control, and protect both operational continuity and reputation.

How Incident Management Software Supports Banks

1. Coordinated Cyber Incident Response

Imagine a ransomware attack affecting critical banking systems. Without a centralised system, IT teams, security officers, compliance staff, and customer service teams might all be working in isolation. Incident management software allows each team to:

- Receive immediate notifications of the incident.

- Access predefined workflows for containment and recovery.

- Track who is doing what in real time, preventing duplicated effort.

This structured approach ensures faster containment, reduces the likelihood of data loss, and allows compliance teams to provide regulators with accurate, timely reports.

2. Managing Operational Disruptions

Operational incidents such as ATM network failures, payment processing outages, or trading platform downtime can create confusion across multiple teams. Incident management software allows financial institutions to:

- Assign tasks to the relevant operational and support teams.

- Keep leadership updated on progress in real time.

- Synchronise internal updates with external communications using Public Alerting software, ensuring clients, regulators, and investors receive accurate information.

This coordination minimises service disruption and ensures the institution maintains trust.

3. Regulatory Compliance and Reporting

Financial regulators demand evidence that incidents were managed systematically. Incident management software provides a detailed audit trail, including:

- Timeline of actions taken.

- Decisions made by key personnel.

- Communication with internal and external stakeholders.

Having this information easily accessible reduces stress during audits and helps institutions demonstrate that they have acted responsibly.

Interested in our Incident Management Software?

Launch and manage incidents in seconds with real-time dashboards, task management, multi-channel alerts, and mobile access for seamless response.

Key Features of Incident Manager

Crises Control’s Incident Manager combines operational efficiency with compliance support. Its key features include:

- Centralised Dashboard: Monitor all active incidents, team assignments, and progress in one place.

- Task Automation: Assign pre-defined actions based on incident type, ensuring nothing is missed.

- Role-Based Access: Staff only see information relevant to their responsibilities.

- Integration with Ping: Connect internal alerts to ensure teams are notified instantly.

- Integration with Public Alerting: Keep clients, regulators, and stakeholders informed via SMS.

- Audit Trails: Automatically log all actions and decisions for regulatory compliance.

Integrating Incident Manager with Crisis Communication

Incident management software does not operate in isolation. By integrating with tools from Crises Control like Ping for internal alerts and Public Alerting for external SMS updates, financial institutions can create a seamless crisis response ecosystem.

- Internal Alerts: Ensure all teams are on the same page regarding tasks, priorities, and updates.

- External Alerts: Communicate key messages to clients, regulators, and investors without delay.

- Holistic View: Leadership sees both internal actions and external communication in real time, allowing informed decision-making.

This integration transforms reactive incident response into proactive management, improving confidence and reducing risk during crises.

Taking Incident Response to the Next Level

Effective incident response is no longer just about solving problems quickly. It’s about coordinating teams, keeping stakeholders informed, and proving compliance. Incident management software provides the tools financial institutions need to handle crises with confidence.

Crises Control’s Incident Manager integrates seamlessly with Ping for internal alerts and Public Alerting for SMS communication, giving banks and financial institutions a single platform to manage cyber and operational incidents from start to finish.

If your organisation wants to streamline incident response and improve coordination, contact Crises Control today to arrange a free demo.

Request a FREE Demo