Written by Anneri Fourie | Crises Control Executive

Crises can strike investment management firms at any time. It might be a sudden IT failure, a cyber breach, or a security incident affecting staff. When these events occur, the challenge is not only resolving the problem but also communicating effectively with everyone involved. Investors, clients, and regulators expect clarity and reassurance, while regulators require accurate reporting and audit trails.

Failing to communicate properly can worsen the situation. A delayed or confusing message can trigger speculation, reduce confidence, and even result in penalties. At the same time, manually managing alerts or relying on multiple disconnected systems can slow response times and create gaps in coverage.

The solution lies in combining clear communication practices with technology designed for emergencies. Mass notification software helps firms send timely updates to the right people, while incident management software coordinates responses and records all actions. Crises Control provides both capabilities in a single platform, allowing investment firms to manage incidents efficiently and protect stakeholders.

Why Mass Notification Software Matters for Investment Firms

Mass notification software allows organisations to send messages to multiple recipients quickly and through various channels. For investment management firms, it addresses three key needs:

- Informing employees quickly about operational disruptions or safety issues

- Updating investors and clients about incidents or service interruptions

- Coordinating internal teams to maintain operations and minimise downtime

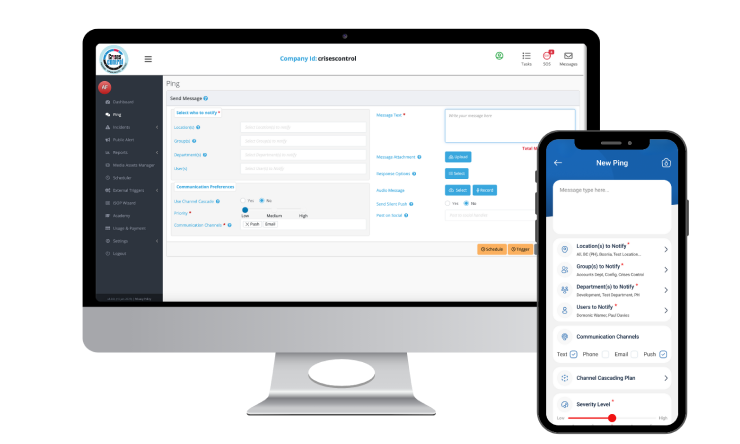

Investment firms often operate across multiple regions, with staff working remotely or travelling. Relying on a single communication channel can leave people uninformed during critical moments. Multi-channel alerts through SMS, email, app notifications, or voice calls ensure messages reach everyone who needs them.

With Crises Control, firms can integrate mass notifications into broader operational workflows. Alerts can trigger predefined response actions, confirm employee safety, and maintain a clear record for regulatory compliance. This makes it easier to respond to incidents effectively without leaving stakeholders in the dark.

Interested in our Ping Mass Notification Software?

Efficiently alert everyone in seconds at scale with our Mass Notification Software.

Coordinating Responses with Incident Management Software

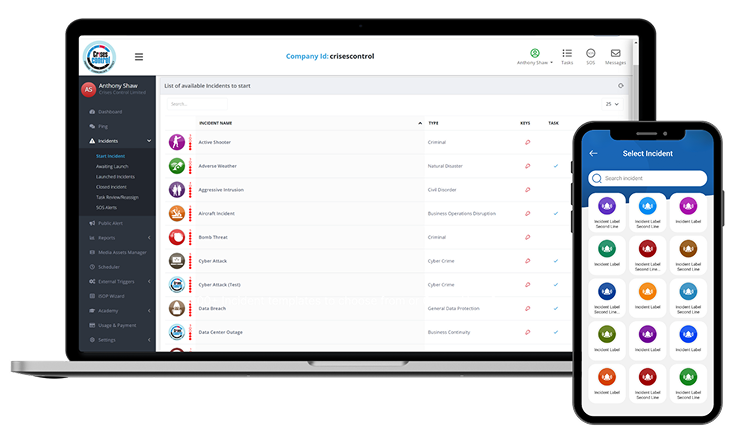

A plan alone is not enough to handle crises. How teams act, communicate, and collaborate under pressure determines the outcome. Incident management software for investment management provides structure for responses, ensuring everyone knows their role and next steps.

Key features include:

- Documenting incidents: Every alert, action, and update is recorded. This allows firms to review responses, improve processes, and provide regulators with clear evidence.

- Assigning roles and responsibilities: Teams follow predefined workflows so tasks are clear, which reduces confusion during high-pressure events.

- Tracking resolution: Metrics such as response time, status updates, and completion reports help firms assess performance and improve readiness for future incidents.

When paired with mass notification software, incident management ensures that all stakeholders are informed while internal teams focus on resolving the issue. For instance, during a system outage, the technical team can work on recovery while notifications go to clients and investors explaining the impact and expected timelines.

Communicating with Investors During a Crisis

Investors expect transparency, even if the situation is evolving. Clear and timely communication maintains trust and reduces reputational risk.

Practical steps include:

- Preparing message templates: Pre-written messages for different incident types allow teams to send alerts quickly without drafting each message from scratch.

- Segmenting audiences: Tailor updates for investors, clients, and regulators so each group receives information relevant to them.

- Providing frequent updates: Even when all details are not available, sharing verified information at regular intervals keeps stakeholders informed.

- Explaining next steps: Clear guidance on what the firm is doing to resolve the issue reassures investors and clients that the situation is being managed.

Crises Control allows firms to manage these communications from a single platform. Alerts can be scheduled, customised, and sent to specific groups. Every message is logged, creating a clear audit trail for compliance purposes and making it easier to meet regulatory reporting requirements.

Protecting Employees with SOS Panic Button Tools

Employee safety is a priority, especially for global teams or staff in high-risk locations. An SOS panic button app for employees in finance companies gives staff a direct way to request help in emergencies, whether they involve personal safety or operational threats.

Key benefits include:

- Real-time location tracking: Enables teams to respond quickly to staff in distress.

- Multiple notification channels: Alerts reach management, security teams, and colleagues at once.

- Integration with incident workflows: Activating an SOS alert triggers predefined steps, ensuring a coordinated response.

Crises Control provides SOS functionality alongside mass notifications and incident management. This ensures employee safety is part of the overall incident response, helping firms meet duty-of-care obligations while maintaining operational continuity.

Interested in our Incident Management Software?

Launch and manage incidents in seconds with real-time dashboards, task management, multi-channel alerts, and mobile access for seamless response.

Regulatory Requirements and Reporting

Investment management firms must comply with a range of regulations that cover operational resilience and incident reporting. These include SEC rules in the USA, FCA obligations in the UK, and EU DORA regulations, among others. Regulators expect clear documentation of incidents, timely reporting, and evidence of consistent processes.

Using mass notification and incident management software supports compliance by:

- Recording alerts and responses: Every message, acknowledgement, and action is time-stamped.

- Maintaining employee safety records: Provides evidence that duty-of-care procedures were followed.

- Generating reports for regulators and auditors: Simplifies review processes and demonstrates that firms have effective incident management practices.

Crises Control helps firms meet these expectations by providing a structured and auditable approach to communication during crises. This reduces the risk of penalties and ensures stakeholders remain confident in the firm’s operational resilience.

Multi-Channel Communication for Effective Crisis Management

Relying on a single communication channel is risky. Different stakeholders may prefer different formats, and some channels may fail during an incident. Best practice includes:

- SMS and push notifications for urgent internal alerts.

- Email for clients, investors, and regulators.

- Voice calls or hotlines for urgent escalations.

- In-app messaging for continuous updates and confirmation tracking.

Crises Control allows firms to coordinate communications across all these channels from a single platform. This ensures messages are delivered reliably and responses are logged automatically, creating a clear chain of communication for both internal use and regulatory review.

Testing and Preparedness

Being prepared means testing processes before a real crisis occurs. Drills and scenario exercises help firms identify gaps and improve workflows.

Practical steps include:

- Scheduling mass notification drills: Check that messages reach all intended recipients.

- Testing incident response workflows: Ensure that teams understand their roles and responsibilities.

- Reviewing performance: Use metrics from drills to refine processes and improve response times.

Routine testing builds confidence among employees and management. It also ensures that if a real incident occurs, communication is organised, swift, and effective, which helps protect investors, clients, and staff.

Practical Steps for Investment Management Firms

To strengthen crisis communication, firms should:

- Combine mass notification software with incident management tools to manage both alerts and workflows.

- Prepare pre-approved communication templates for investors, clients, and staff.

- Segment audiences to deliver targeted messages.

- Maintain an audit trail of communications for regulatory compliance.

- Use SOS tools to protect employees and integrate these alerts into incident response plans.

- Run drills regularly to test both communication and operational workflows.

Crises Control offers these capabilities in one platform, giving firms the tools to respond efficiently, communicate clearly, and maintain stakeholder trust during crises.

Final Thoughts

Handling crises effectively requires preparation, clear communication, and reliable tools. Firms that implement mass notification software for financial firms alongside incident management software are better able to protect staff, maintain investor trust, and comply with regulatory requirements.

Crises Control combines these capabilities in a single platform, allowing investment management firms to respond quickly, communicate clearly, and keep all stakeholders informed.

Book a free demo today to see how Crises Control can help your firm strengthen crisis communication and maintain confidence during challenging situations.

Request a FREE Demo