Written by Anneri Fourie | Crises Control Executive

When a spill is contained or a fire is extinguished, there is usually a moment of relief.

Production restarts. Equipment is inspected. Teams debrief informally. The immediate danger has passed.

That is when the difficult questions begin.

Who made the first escalation decision?

When were authorities notified?

What information was available at each stage?

Who authorised containment measures?

In oil and gas, regulatory incident reporting is not a document created after the emergency. It is the record of how you behaved during it.

The problem is straightforward. Many organisations still treat compliance reporting as a separate administrative phase that starts once operations stabilise. By that stage, evidence is already fragmented across emails, personal phones, paper notes and memory.

The solution is equally straightforward. Audit trails must be built into the response itself, not reconstructed later.

This article explains why regulatory incident reporting often breaks down in practice, what regulators actually expect, and how structured digital processes strengthen compliance after emergencies in oil and gas operations.

A Clear Definition Of Regulatory Incident Reporting

Regulatory incident reporting is the formal process of documenting and communicating the facts, decisions and actions associated with an operational incident to relevant authorities and stakeholders.

In oil and gas, this typically involves:

- Recording what happened and when

- Capturing who declared and owned the incident

- Documenting escalation decisions

- Preserving internal and external communication

- Demonstrating compliance with post-incident reporting requirements

It is not simply a report submitted days later.

It is a traceable timeline that begins at the first alert and continues through containment, recovery and corrective action.

If that timeline cannot be evidenced clearly, credibility weakens.

Why Audit Trails Break Down In Real Incidents

During a spill or fire, nobody is thinking about an audit file.

They are thinking about containment, safety and operational stability.

Under pressure:

- Decisions are made verbally

- Instructions are sent through messaging apps

- Phone calls replace formal updates

- Notes are scribbled on paper

- Updates are shared across disconnected systems

These behaviours are understandable. Speed matters in the moment.

The difficulty appears later.

When compliance reporting begins, teams attempt to rebuild the sequence of events. They search inboxes. They ask colleagues to recall conversations. They compare different versions of what happened.

Small inconsistencies emerge.

The timeline shifts by an hour.

Escalation appears later than it actually occurred.

Notification records are incomplete.

At that stage, regulatory incident reporting becomes defensive rather than controlled.

A Realistic Scenario: Where Reconstruction Fails

Consider a refinery experiencing a small but reportable chemical spill.

The operations supervisor calls the safety manager directly. A containment team is mobilised. A contractor receives instructions by text message. The environmental team is informed verbally. No formal incident is declared within a structured system because the spill appears manageable.

Four days later, the incident is confirmed as reportable.

Compliance teams now need:

- The exact time the spill was detected

- When escalation occurred

- When external authorities were notified

- What corrective measures were authorised

Some details are clear. Others are not.

The supervisor remembers the call at 14:10. The safety manager believes it was closer to 14:25. The contractor cannot locate the original message. Email timestamps do not reflect verbal updates.

No one acted irresponsibly. The response was operationally sound.

The documentation was not.

This gap between effective response and defensible evidence is where regulatory risk increases.

What Regulators Actually Expect

Reporting requirements vary by jurisdiction, but expectations share common themes.

Regulators look for evidence of:

- Timely classification of the incident

- Clear ownership of response

- Structured internal coordination

- Appropriate and timely notification

- Documented corrective action

They do not rely on verbal reassurance. They rely on traceable records.

When reviewing regulatory incident reporting, authorities often focus on practical questions:

- Who knew about the incident at each stage?

- What information was available when decisions were taken?

- Was escalation aligned with defined criteria?

- Were stakeholders informed appropriately?

- Were corrective measures tracked and completed?

An organisation that can answer these questions clearly demonstrates governance discipline.

An organisation that reconstructs answers after the fact appears reactive.

The Operational Reality Behind Compliance After Emergencies

Spills, fires and near misses rarely occur under controlled conditions.

They overlap with:

- Shift changes

- Offshore or remote sites

- Severe weather

- Contractor involvement

- System outages

Leaders must prioritise safety and containment. They should.

The challenge is ensuring that documentation discipline does not collapse during that pressure.

Expecting individuals to remember every escalation detail during a high-stress event is unrealistic.

Compliance after emergencies must be embedded into workflow rather than dependent on memory.

Manual Versus Digital Incident Audit Trails

The difference between manual and digital processes becomes clear during scrutiny.

Manual Coordination

- Incident declared verbally

- Tasks assigned informally

- Updates shared through email and messaging

- Logs updated retrospectively

- Reports compiled after resolution

This method depends heavily on individual discipline and consistency.

Digital Coordination

- Incident declared formally within an incident management software platform

- Ownership assigned immediately

- Role-based tasks created automatically

- Communications logged in real time

- Actions time-stamped and preserved

The benefit is not administrative convenience.

The benefit is defensibility.

A structured incident audit trail supports regulatory incident reporting without requiring reconstruction.

The Human Factor In Documentation Gaps

People do not ignore compliance intentionally.

Documentation gaps usually stem from:

- Cognitive overload

- Assumptions that someone else is recording decisions

- Overconfidence that memory will suffice

- Underestimation of reporting requirements

In complex environments such as oil and gas, the volume of simultaneous activity makes fragmented documentation almost inevitable without structural support.

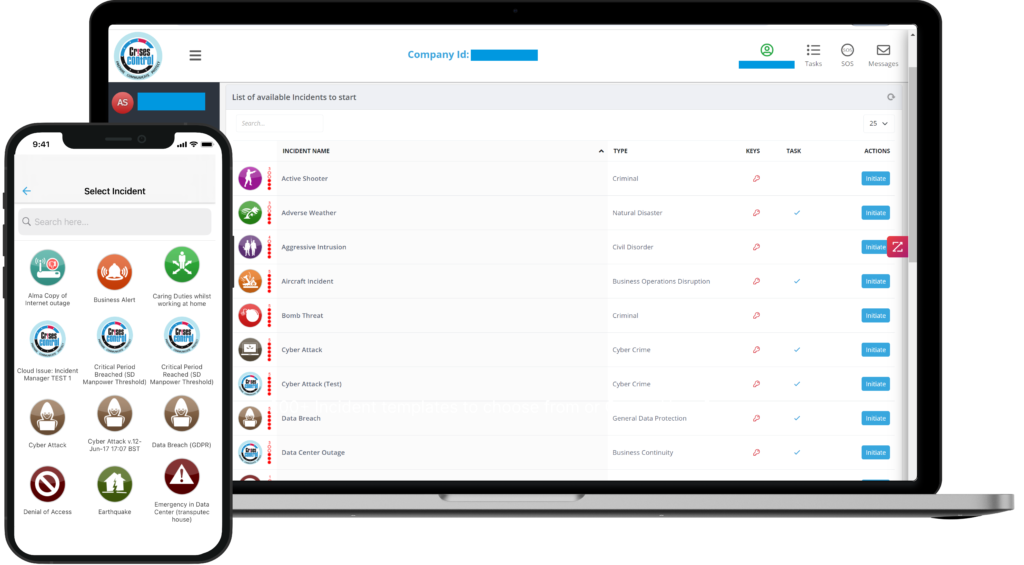

Incident management software reduces this reliance on memory by:

- Prompting escalation steps

- Capturing acknowledgements

- Logging notifications automatically

- Recording task completion

This supports compliance reporting while allowing teams to focus on operational priorities.

Interested in our Incident Management Software?

Flexible Incident Management Software to keep you connected and in control.

Near Misses And Hidden Regulatory Risk

Major events attract attention.

Near misses often do not.

That is where risk accumulates quietly.

Near misses provide insight into systemic weaknesses. Regulators increasingly examine how organisations track and analyse these events.

Failing to document near misses consistently suggests weak internal governance.

A disciplined approach ensures:

- Near misses are logged formally

- Escalation decisions are documented

- Corrective actions are assigned and tracked

- Patterns are analysed over time

An effective incident audit trail strengthens both regulatory compliance and internal safety culture.

Integrating Communication Into Regulatory Incident Reporting

Communication records form a critical part of regulatory scrutiny.

Mass notification software contributes directly to defensible audit trails by capturing:

- Who was notified

- When notifications were sent

- Who acknowledged receipt

- What message content was delivered

Without structured communication logging, organisations may struggle to demonstrate that appropriate stakeholders were informed in a timely manner.

Communication is not separate from reporting. It is part of the evidence.

A Practical Framework For Strong Audit Trails

If you are evaluating your current approach, assess it against five elements:

- Immediate Formal Declaration: Incidents meeting defined criteria are declared within a structured system.

- Named Ownership: A specific individual is recorded as incident owner.

- Role-Based Task Allocation: Tasks are assigned by function and tracked centrally.

- Real-Time Logging: Decisions and communications are automatically time-stamped.

- Structured Reporting Output: The system can generate clear reports aligned with post-incident reporting requirements.

These elements reduce the gap between response and regulatory documentation.

How Crises Control Strengthens Accountability

Crises Control supports regulatory incident reporting by embedding documentation into the response workflow itself.

Through digitalisation of crisis and continuity plans, organisations can:

- Activate structured, role-based response immediately

- Capture time-stamped actions automatically

- Maintain centralised communication logs

- Access incident records securely via cloud infrastructure

The platform does not replace leadership judgement. It ensures that leadership decisions are recorded clearly and consistently.

For oil and gas operators reviewing the best incident management platform for oil and gas, the critical question is not only how well it coordinates response.

It is how well it preserves evidence of that coordination.

Challenging A Comfortable Assumption

Many leaders assume that if their team handled the incident responsibly, documentation will naturally reflect that.

Experience shows otherwise.

Operational competence and documentation discipline are not the same.

Without structured systems:

- Timelines blur

- Verbal decisions go unrecorded

- Escalation appears delayed

- Corrective actions lack attribution

Strong regulatory incident reporting depends on structured processes, not memory.

Embedding audit discipline into response removes reliance on retrospective effort.

The Long-Term Impact Of Weak Reporting

Weak compliance reporting carries broader consequences than fines.

It can lead to:

- Increased regulatory scrutiny

- Insurance complications

- Reputational strain

- Board-level concern

- Erosion of stakeholder trust

Strong audit trails demonstrate systematic risk management.

They show that the organisation does not simply react to incidents. It governs them.

Closing The Gap Between Response And Reporting

Regulatory incident reporting should not begin after a spill or fire is resolved.

It should begin at the first alert.

Spills, fires and near misses test operational capability. They also test governance discipline.

A structured incident management process ensures that:

- Ownership is clear

- Escalation is traceable

- Communication is logged

- Corrective actions are documented

Crises Control supports this disciplined approach by embedding audit structure into every stage of incident response, so compliance is not an afterthought but a natural output of coordinated action.

If you are reviewing your current approach to regulatory incident reporting in oil and gas, examine whether your audit trail is created in real time or reconstructed afterwards.

Request a FREE Demo