Written by Anneri Fourie | Crises Control Executive

Banks face situations that can disrupt operations, threaten staff safety, and put customers at risk. A minor power outage at a branch can turn into lost transactions, delayed services, and confusion for employees if communication is slow. A security breach or flood affecting multiple branches can bring normal operations to a standstill and create serious reputational damage. Crisis management software for banks provides a way to manage these situations efficiently. It allows banks to send alerts, coordinate responses, and track outcomes across multiple locations while meeting regulatory requirements.

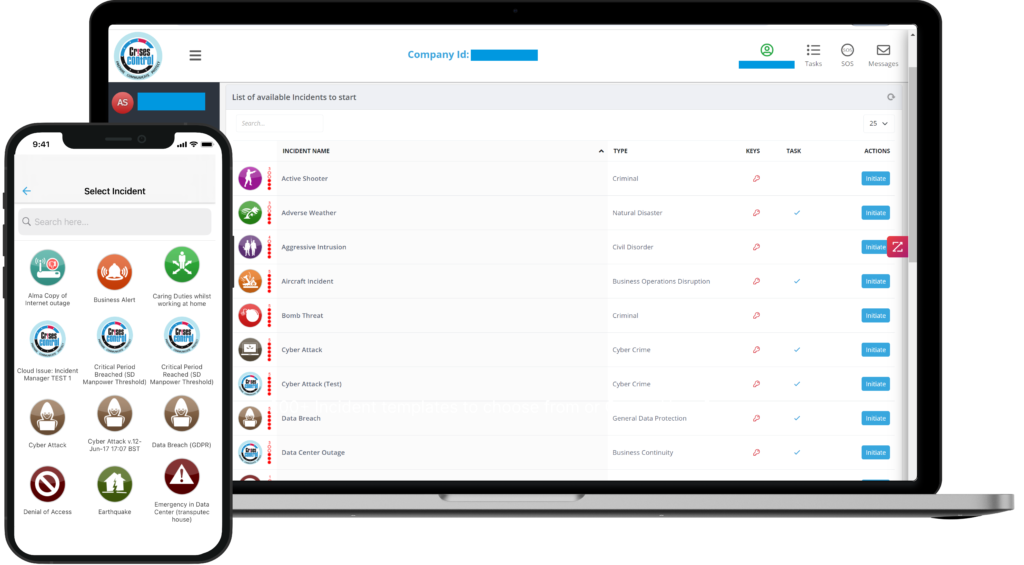

At its core, crisis management software centralises incident management, notifications, and response actions. It gives managers a clear picture of what is happening, who is responsible for resolving it, and whether every step has been logged for compliance purposes. By using a digital system instead of relying on phone calls, emails, or spreadsheets, banks can handle incidents quickly and reduce operational risk.

Why Crisis Management Is Especially Challenging for Banks

Banks operate under intense pressure with multiple locations, strict regulatory obligations, and a high expectation of uninterrupted service. These factors make managing incidents particularly complex:

- Multi-branch operations: Branches, ATMs, and regional offices require coordinated communication. A single missed message can leave staff unsure of how to respond.

- Regulatory obligations: Banks must be able to show that they can continue operations during incidents. This includes documenting responses and reporting to authorities such as the FCA, PRA, FFIEC, or DORA compliance bodies.

- Staff safety and duty of care: Managers are legally responsible for ensuring that employees are informed and safe during emergencies.

- Customer and reputational risk: Slow or poorly coordinated responses can lead to service disruptions, loss of customer confidence, and negative media attention.

Traditional methods such as phone trees or email chains are not designed for the speed and clarity required during incidents. When alerts are slow or unclear, small issues can escalate into larger problems.

Where Traditional Approaches Often Fail

Understanding common pitfalls helps banks see why a digital solution is necessary.

- Fragmented communication: Using different systems for alerts, emails, and phone calls leads to messages being missed or delayed.

- Outdated escalation procedures: Static contact lists or generic notifications cannot account for the specific location of an incident or the roles of different staff members.

- Limited audit trails: Manual tracking makes it hard to show regulators that the bank responded appropriately.

- Ignoring minor incidents: Small branch-level events, like equipment failures, may seem trivial but can cascade into larger operational challenges if staff are not guided effectively.

Manual processes place extra cognitive load on employees during stressful events. Mistakes are more likely when people must coordinate across multiple channels or interpret ambiguous instructions.

How Digital Crisis Management Makes a Difference

A digital platform, including an incident management platform with SOS alerts, addresses these challenges. Banks gain measurable improvements in both speed and accuracy of responses.

Key benefits include:

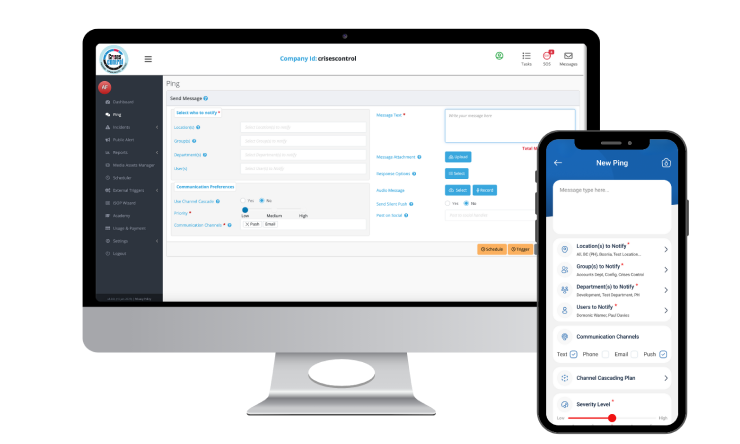

- Rapid communication: Alerts can be sent instantly to the right staff based on their location or role. This ensures real-time incident alerts for bank employees and removes uncertainty during an incident.

- Clear responsibilities: Staff receive specific, role-based instructions so there is no confusion about who needs to do what.

- Audit-ready records: Every alert, acknowledgement, and response is logged, helping banks demonstrate compliance with FCA, PRA, DORA, FFIEC, and other regulatory frameworks.

- Multi-location oversight: Central dashboards allow managers to see the status of incidents across branches, ATMs, and regional offices in real time.

- Automated recovery workflows: Predefined processes can trigger automated disaster recovery notifications for banking operations, reducing downtime and keeping branches operational.

Digital solutions reduce reliance on human memory and coordination during emergencies, which lowers error rates and ensures consistent, verifiable responses.

Interested in our Incident Management Software?

Flexible Incident Management Software to keep you connected and in control.

Real-World Applications for Financial Institutions

Using crisis management software effectively means understanding different scenarios and applying appropriate workflows:

Minor Branch-Level Incidents

- Problem: Power failure, equipment malfunction, or localised disruption.

- Impact: Staff uncertainty, inconsistent communication, delayed services.

- Solution: Use an emergency mass notification system for financial institutions to send targeted alerts and confirm staff safety. The platform can record who received and acknowledged the message, ensuring managers have clear visibility.

Major Incidents

- Problem: Fire, flood, or security breach affecting multiple branches.

- Impact: Branch closures, operational disruption, and customer dissatisfaction.

- Solution: Activate a full digital response plan. Role-based tasks are assigned, responses are tracked, and audit logs provide regulators with evidence that the incident was handled appropriately.

Multi-Branch Coordination

- Problem: Conflicting or delayed messages across branches.

- Impact: Decisions are postponed, responsibilities overlap, and operations are disrupted.

- Solution: Use central dashboards with location-specific notifications. Staff and managers see exactly which branches are affected and what actions need to be taken, making coordination straightforward.

Interested in our Ping Mass Notification Software?

Efficiently alert everyone in seconds at scale with our Mass Notification Software.

Regulatory and Compliance Considerations

Banks must meet strict regulatory requirements. Crisis management software helps meet these obligations while reducing administrative burden.

| Region | Key Regulations | Requirement | How Software Supports Compliance |

| UK | FCA, PRA, Operational Resilience Policy | Incident response, communication, testing | Logged alerts, response evidence, audit-ready reports |

| EU | DORA, GDPR | Incident reporting, data protection | Secure alerts, role-based access, audit trails |

| Middle East | Central Bank regulations | Business continuity and incident response | Regional hosting, controlled access |

| USA | FFIEC, SEC, FINRA | Operational resilience, incident reporting | Structured incident logs, notifications, reporting |

| Canada | OSFI, PIPEDA | Business continuity, privacy | Secure communications, compliance-ready reporting |

Centralising alerts, responses, and logs in a digital platform ensures banks can provide evidence to regulators quickly and accurately. This reduces the risk of non-compliance and demonstrates preparedness during audits.

Common Misconceptions About Banking Crisis Management

A widely held assumption is that sending an email is enough to inform staff of an incident. This often fails in practice.

- Staff may be away from desks, using different devices, or not actively checking email.

- In high-stress situations, unclear messages can be ignored or misinterpreted.

A more effective approach combines multiple communication channels, such as mobile notifications, SMS, and integration with platforms like Microsoft Teams. This ensures crisis management and emergency response for multi-site banks reaches everyone reliably.

How to Choose the Right Platform

When evaluating digital solutions, banks should consider:

- Integration: Does it work with existing systems and tools?

- Actionable workflows: Can it assign tasks based on roles and escalate if required?

- Audit and reporting: Does it automatically record alerts, acknowledgements, and actions?

- Global reach with localisation: Can it coordinate across branches while respecting regional compliance requirements?

- Reliability: Is it cloud-based with guaranteed uptime, even during IT outages?

A platform that meets these criteria helps banks reduce operational risk, meet compliance obligations, and protect employees and customers.

Practical Steps for Banks to Improve Readiness

- Identify risks across all locations: Include branch-specific hazards, IT vulnerabilities, and security threats.

- Create role-based response plans: Define responsibilities for each type of incident.

- Test response procedures regularly: Conduct simulations to check staff response and system reliability. Digital platforms that support real-time incident alerts for bank employees make testing straightforward.

- Keep complete audit trails: Ensure every alert and action is logged to satisfy regulatory obligations.

- Use multi-channel notifications: Reach staff through mobile, desktop, and collaboration tools to guarantee awareness during incidents.

By following these steps, banks can turn a reactive crisis approach into a structured, reliable system.

Bringing It Together

Crisis management in banking is not just about responding to major disasters. Even minor issues can affect operations, staff safety, and customer confidence. Digital systems that combine business continuity software with emergency mass notification systems provide a practical framework for managing incidents efficiently.

These platforms centralise communication, coordinate response actions, and maintain compliance-ready records. Staff are clear about what to do, managers can oversee operations across all locations, and regulators can see documented evidence of preparedness. The result is faster resolution, reduced risk, and continued trust from customers and employees.

Crises Control provides a platform that helps banks put this approach into practice. By digitalising crisis and continuity plans, offering role-based incident response, and ensuring reliable communication across all branches, it gives banks the tools to manage incidents effectively while meeting regulatory obligations.

Request a FREE Demo