Written by Anneri Fourie | Crises Control Executive

Banks are expected to keep running when things go wrong. Cash still needs to be accessible. Payments still need to clear. Staff still need to know what to do. Regulators expect clear evidence that disruption was anticipated, managed, and learned from.

The problem is that many banks only discover weaknesses in their operational resilience when an incident exposes them. Plans exist, policies are approved, and tests are completed. Yet when a real disruption happens, response becomes fragmented, communication breaks down, and leadership struggles to see what is actually happening across branches.

This is where operational resilience software for banks shifts from being a planning aid to becoming a practical part of day-to-day readiness. It helps organisations prepare for disruption, respond with control, and demonstrate that decisions and actions were taken deliberately rather than reactively.

This article explores why operational resilience remains difficult in financial services, what often goes wrong in practice, and how banks can strengthen crisis readiness in a way that stands up to regulatory scrutiny.

What operational resilience means in practice

Operational resilience is a bank’s ability to continue delivering its most important services during disruption, while limiting harm to customers, staff, and the wider financial system.

In practical terms, it means:

- Knowing which services cannot fail

- Understanding what could disrupt those services

- Responding in a controlled and coordinated way

- Proving that the response was appropriate to regulators and auditors

Operational resilience is not a document or a single annual exercise. It is a way of operating that connects planning, communication, decision-making, and review.

Why operational resilience is difficult for banks

Banks invest heavily in frameworks, policies, and controls. Yet resilience often breaks down during live incidents. This usually happens for very practical reasons.

Complexity across branches and regions

Banks operate across multiple branches, business units, and jurisdictions. Roles and responsibilities differ by location. Escalation paths vary. During disruption, this complexity slows decisions and creates uncertainty about who should act and when.

Plans that do not translate into action

Business continuity plans are often detailed and well maintained. They describe what should happen, but not how teams behave when systems fail, buildings close, or staff availability changes.

Regulatory pressure during live events

Financial services organisations are under constant scrutiny. Regulators expect evidence that disruption was managed properly. Reassurance is not enough. Banks need to show who was informed, what actions were taken, and how outcomes were reviewed.

Human behaviour under stress

When pressure rises, people rely on familiar habits. Email, phone calls, and informal messaging take over. Visibility drops, decisions fragment, and accountability becomes unclear.

Real-world disruptions that test resilience

Minor branch-level incidents

Local incidents such as power outages, flooding, or security alerts may not justify a full crisis response. They still require coordination, clear communication, and documented decisions. Inconsistent handling across branches often reveals gaps in readiness.

Larger operational incidents

Building damage, IT failures, or cyber incidents can affect several locations at once. Manual coordination struggles to scale. Messages become inconsistent, and leadership loses a clear view of what is happening across the organisation.

Staff safety events

Medical emergencies or threatening behaviour create immediate duty of care responsibilities. Without structured communication and tracking, banks struggle to know who is safe and who needs support.

Business continuity software for financial services

Business continuity software supports preparedness by moving plans out of static documents and into accessible systems.

When used well, continuity software allows banks to:

- Store and maintain plans centrally

- Assign ownership for actions and decisions

- Access plans during system outages

- Link response actions to communication

This improves readiness. It does not guarantee resilience on its own. Plans need to connect directly to live incident response.

Crisis management platform for banking operations

A crisis management platform helps banks coordinate response when plans meet reality.

Effective platforms focus on:

- Role-based actions rather than generic checklists

- Clear escalation paths

- Real-time visibility of progress and decisions

- Integrated communication rather than ad hoc messaging

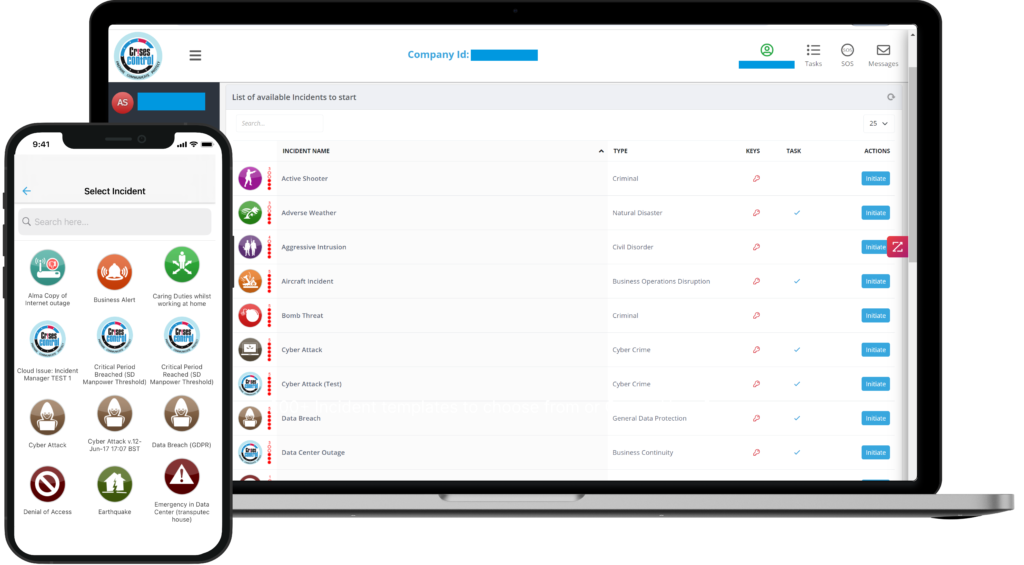

Platforms such as Crises Control show how crisis and continuity plans can be digitalised into practical workflows that guide teams during disruption.

Incident management software for regulated organisations

Incident management software focuses on execution and evidence.

For regulated organisations, this means:

- Logging incidents as they occur

- Tracking decisions and actions

- Recording communication and acknowledgements

- Producing reports suitable for internal review and regulatory engagement

This becomes critical when banks need to explain not only what happened, but how they responded and what they learned.

How banks prove operational resilience during regulatory audits

Regulators do not expect incidents to be avoided entirely. They expect control, accountability, and learning.

During audits, banks are often asked to demonstrate:

- How incidents were identified and escalated

- Who was informed and when

- What actions were taken

- How improvements were made afterwards

Manual records, emails, and informal notes rarely provide a complete picture. Structured systems that log communication, actions, and outcomes make it far easier to present a clear and defensible narrative.

Interested in our Incident Management Software?

Flexible Incident Management Software to keep you connected and in control.

A common assumption that causes problems

Many organisations believe that resilience is proven through testing alone.

Exercises and simulations are useful. They do not replace operational readiness. Tests show what might happen in a controlled setting. Real incidents reveal how people actually behave.

Banks that rely too heavily on testing often find that:

- Contact details are outdated

- Decision rights are unclear

- Communication tools fail under pressure

- Evidence is difficult to reconstruct afterwards

Resilience improves when preparation is supported by tools that help people act clearly during real events.

Operational resilience and crisis readiness for multi-branch banks

Multi-branch operations introduce additional complexity:

- Different local conditions

- Varying staff availability

- Regional regulatory expectations

Operational resilience improves when banks can:

- Target communication by location and role

- Activate predefined response workflows

- Maintain central visibility without removing local authority

- Adapt response as incidents develop

Cloud-based access plays an important role, ensuring teams can act even when offices or internal networks are unavailable.

Incident response and continuity planning for financial institutions

Strong resilience connects planning and response rather than treating them as separate activities.

Effective approaches include:

- Digitalised plans linked directly to live actions

- Clear ownership for each response step

- Integrated communication with confirmation

- Post-incident review based on recorded evidence

This creates a continuous cycle of preparation, response, and improvement.

The role of communication in resilience

Communication failures often create more disruption than the incident itself.

Reliable emergency communication supports resilience by:

- Reducing uncertainty for staff

- Ensuring instructions reach the right people

- Providing visibility into acknowledgements and status

- Supporting duty of care responsibilities

Two-way communication and SOS capabilities strengthen control during safety-related events.

Practical questions for banking leaders

When reviewing your current approach, consider:

- Can response be activated without relying on individual knowledge?

- Do staff know exactly what is expected during disruption?

- Can leadership see progress without chasing updates?

- Would the response stand up to regulatory review?

If these questions are difficult to answer, resilience may exist on paper rather than in practice.

Building confidence through repeatable response

Banks that invest in operational resilience software experience a shift in how incidents are handled.

Response becomes:

- More predictable

- Less dependent on individual effort

- Easier to review and improve

Over time, this builds confidence across leadership teams, frontline staff, and regulators.

Next steps

Operational resilience is built through preparation supported by tools that help people act with clarity under pressure.

If you are reviewing how your organisation prepares for disruption, strengthens continuity, and demonstrates control during incidents, it may be time to reassess how plans translate into action.

Request a FREE Demo