Incident Management and Mass Notification Software for Financial Services and Insurance

Protecting Financial Services and Insurance from Costly Disruptions

The financial services and insurance sector handles trillions of dollars in assets and investments, operating in a fast-paced, high-risk environment. Business disruptions can lead to significant financial losses, regulatory penalties, and long-lasting reputational damage.

Traditional communication tools often fall short in meeting the complex demands of this industry. That’s why incident management software for financial institutions must deliver:

- Rapid, targeted mass notifications across multiple channels

- Audit-ready reporting and complete traceability to support compliance with FCA, DORA, Solvency II, ISO 22301, and other international regulatory standards

- Role-based coordination to streamline executive and frontline response

- Scalable communication that supports thousands of employees in distributed locations

- Integration with business continuity software for insurance and financial organisations

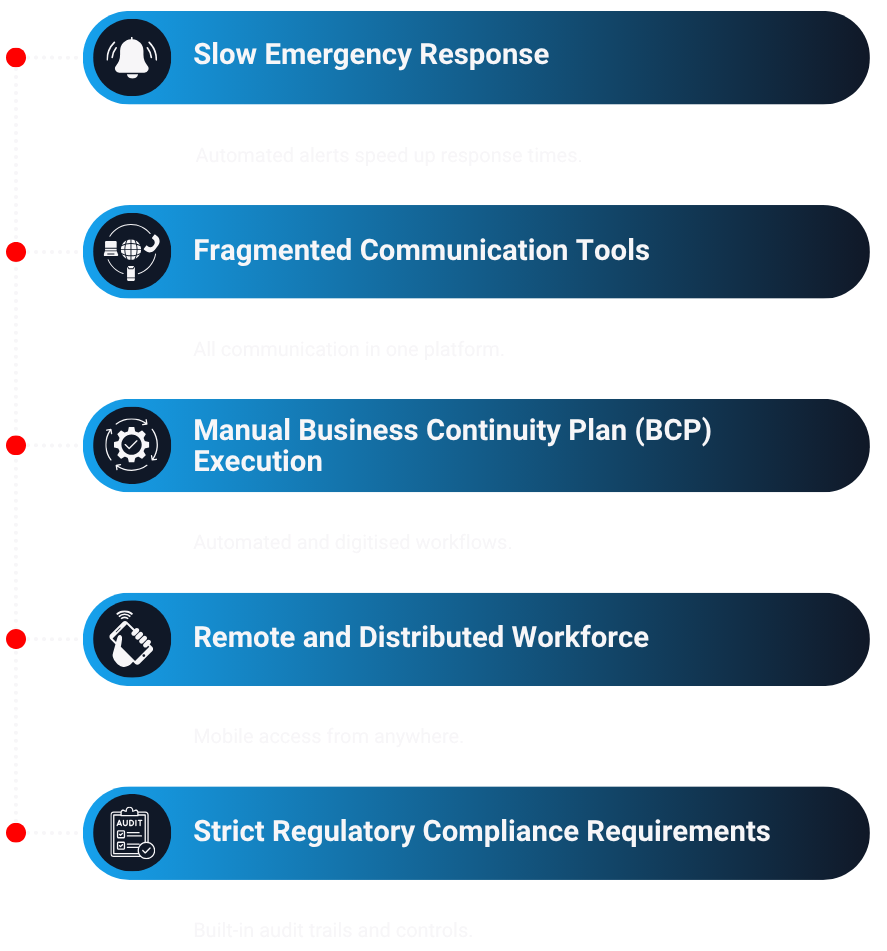

Top 5 Incident Management Challenges Solved by Crises Control

Key Benefits of Crises Control for Financial Services and Insurance

Crises Control is built for today’s mobile, decentralised teams. It helps you respond quickly, communicate securely, and stay compliant during any business disruption.

Regulatory Compliance Made Easy

With built-in audit trails and detailed reporting, Crises Control helps financial and insurance organisations meet strict compliance requirements like FCA, DORA, and other global regulations.

Secure, Centralised Communication

All alerts, updates, and incident logs are managed through a single, encrypted platform, eliminating fragmented tools and ensuring data security and audit readiness.

Faster, Smarter Incident Response

Crises Control enables rapid communication and one-click deployment of business continuity plans, reducing downtime and minimising financial impact during crises.

Case study - Financial Services Provider

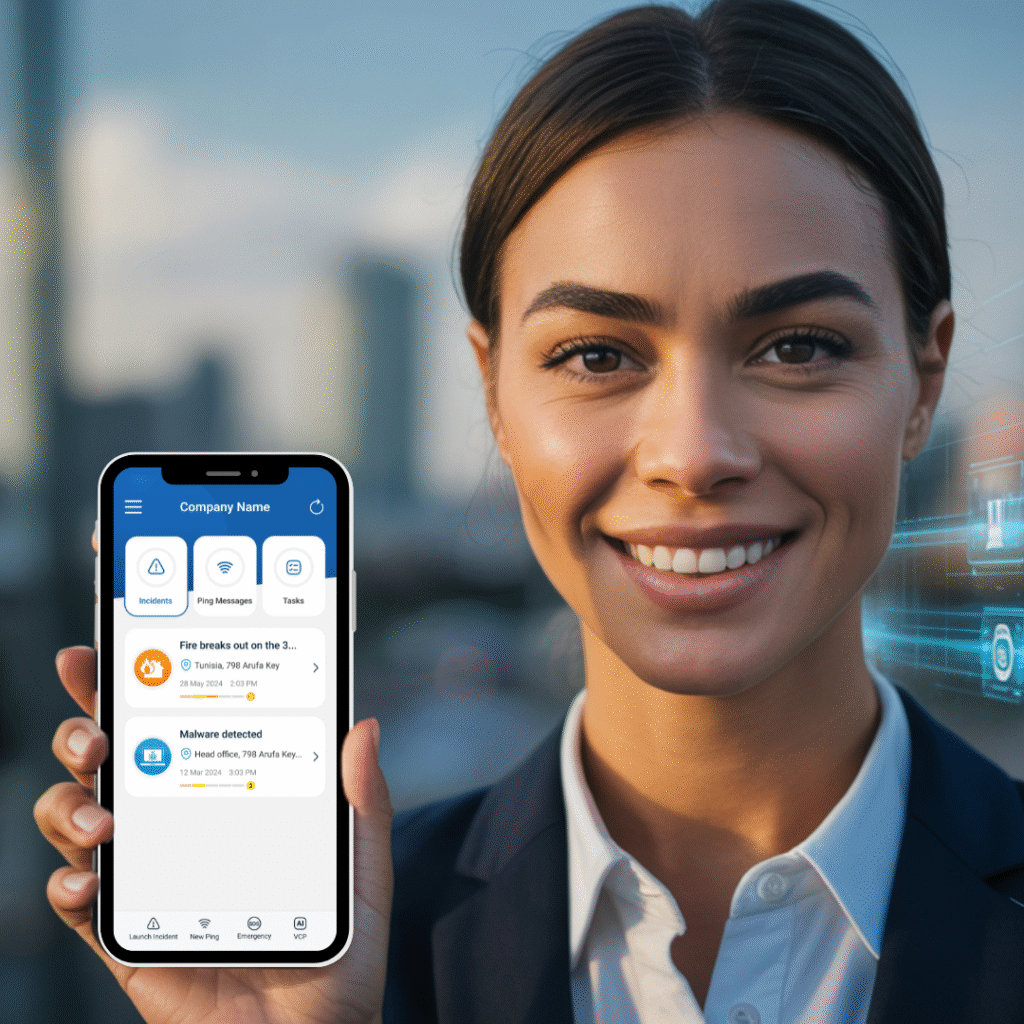

A leading financial services provider, with 400 employees in London, needed an incident notification platform to alert employees at their London City HQ, and also travelling across Europe, of critical incidents via cloud-hosted e-mail, SMS, telephone call and push notification.

They needed a multi-channel incident notification platform to warn employees of critical incidents, whilst they were either office based or on the move.

The global spread presents a significant communications challenge in terms of delivery of critical messages and security. They also needed to be able to check on the location and safety of individual employees who were travelling and receive responses from them.

Our priority is to get information out clearly and concisely to our staff and prompt them to respond quickly.

Director of HR, Leading Financial Services Provider

FAQs

Crises Control delivers instant notifications via SMS, email, voice calls, Microsoft Teams, and mobile app, ensuring your entire team is informed within seconds.

Yes, our platform supports integration with popular tools like Microsoft Teams and can centralise multiple communication channels for seamless incident management.

It provides comprehensive audit trails, detailed incident reports, and secure communication logs, making it easier to meet FCA, DORA, and other global regulatory requirements.

Absolutely. The platform is mobile-first and designed to keep remote or multi-location teams connected and informed instantly, no matter where they are.

All communications are encrypted end-to-end, ensuring sensitive information stays protected during incidents.

Typical pain points include slow emergency alerts, fragmented communication channels, manual and hard-to-activate business continuity plans, difficulty reaching remote teams quickly, and strict regulatory compliance demands.