Written by Anneri Fourie | Crises Control Executive

The Cost of Getting Incident Reporting Wrong

When a major incident hits an investment firm, time is not the only thing at risk. A delay in reporting can lead to regulatory penalties, shaken investor confidence, operational disruption and legal action. This isn’t just about dealing with a crisis quickly; it’s about how well a firm can communicate, document and respond under pressure.

Regulators such as the SEC in the United States, the European Union under DORA, and the UK’s FCA have made it clear: incidents must be reported accurately and fast. Manual reporting methods or fragmented communication tools leave too much room for error and delay.

The solution lies in structured and reliable Incident Management Software. By automating communication, providing clear audit trails and enabling fast incident reporting, firms can protect their operations and meet regulatory obligations without scrambling for information.

Why Regulatory Pressure Is Increasing for Investment Management Firms

Investment management is a tightly regulated sector, and the expectations around incident reporting are rising. Regulators no longer want vague timelines or partial reports; they want clarity, speed and proof of response.

While rules vary between regions, the principles are similar. Firms must be able to detect incidents quickly, alert the right people and prove what action was taken. This shift places pressure on firms to modernise their approach to incident handling.

SEC Requirements in the United States

The SEC has proposed specific cybersecurity incident reporting rules that apply to investment advisers and funds. Under these rules, firms must report significant cybersecurity incidents within 48 hours once they have a reasonable basis to believe an incident is happening.

The SEC has also updated Regulation S-P to ensure firms have structured incident response programmes and that affected parties are notified in a timely manner. Public companies must disclose material cybersecurity incidents through Form 8-K within four business days.

Missing these timelines can lead to enforcement actions, legal risk and reputational damage.

DORA in the European Union

The Digital Operational Resilience Act (DORA) has set new expectations for how financial entities handle ICT-related incidents. The regulation requires rapid reporting, structured documentation and a clear demonstration of operational resilience. This means firms need to move away from fragmented response plans and towards coordinated, tested processes.

FCA and PRA Requirements in the UK

The Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) require investment firms to inform regulators when incidents have a material impact on services or clients. These expectations are aligned with broader operational resilience frameworks, which also focus on how quickly and effectively a firm responds.

This is about more than just ticking a box. Regulators are looking for firms that can prove they have strong internal processes, not just written policies.

What Happens When Reporting Goes Wrong

Poor incident reporting can have wide-reaching effects. When delays or gaps occur, the consequences are often serious:

- Regulatory penalties: Missed reporting deadlines can trigger investigations or fines.

- Reputational harm: Investors expect timely and transparent communication. A slow or weak response can erode trust.

- Operational disruption: Manual reporting methods can slow down recovery efforts, keeping systems and people offline for longer.

- Legal exposure: Failure to notify regulators or affected parties can lead to legal action.

Many firms still rely on spreadsheets, email chains and phone trees during incidents. These methods often create confusion, duplicated work and incomplete records. In a regulatory review, that can be a serious weakness.

Why Incident Management Software Helps Firms Stay Compliant

A structured platform gives firms a way to respond to incidents in a consistent and timely manner. Instead of chasing updates or manually logging actions, everything is coordinated through one system.

Incident Management Software removes uncertainty and reduces the time spent on basic communication and reporting, allowing teams to focus on solving the actual problem.

Real-Time Notifications and Escalation

When an incident is identified, the system can send alerts instantly through SMS, push notifications, voice calls and email. Teams are informed at once, which reduces confusion and delays.

Centralised Evidence and Audit Trails

Regulators often ask firms to show how they responded, including who was notified and when. A platform with automated logging creates a time-stamped record of every action. This means less time gathering evidence and more time focusing on the response itself.

Role-Based Incident Response

Incidents often involve multiple teams: compliance, cybersecurity, operations and investor relations. Role-based workflows make sure that each team receives the information they need without being flooded with irrelevant details. This keeps communication clear and focused.

Pre-Approved Templates for Faster Reporting

Having ready-to-use message templates for SEC, DORA and FCA reporting saves precious time. These templates can be customised but ensure the key information is always included.

Creating a Practical Incident Response Plan for Investment Firms

Regulations don’t manage incidents. People and processes do. Every investment firm needs a clear, structured incident response plan that aligns with regulatory expectations and can be followed under pressure.

Key elements include:

- Clear reporting triggers: Define what makes an incident reportable under each regulation.

- Notification protocols: Identify who needs to be alerted first, including internal teams, regulators and service providers.

- Evidence capture: Make sure every action, alert and acknowledgement is logged automatically.

- Regular testing: Run scheduled drills to keep teams prepared and refine response plans.

- Regional readiness: For firms operating across multiple jurisdictions, reporting processes must adapt to each region’s regulatory requirements.

When these elements are embedded into digital workflows, response times improve, and reporting becomes accurate and consistent.

How to Comply with DORA Reporting Requirements

DORA has introduced stricter reporting expectations for financial institutions. To comply, investment firms should:

- Classify incidents correctly: DORA separates major and non-major incidents, each with its own reporting requirements.

- Act fast: Major incidents often need to be reported within hours, not days.

- Use structured reporting templates: Consistency is key when regulators expect clear and complete information.

- Keep detailed records: Communication and escalation logs may be reviewed during audits.

- Manage third-party reporting: Vendors and service providers must follow reporting timelines too.

Incident Management Software supports these steps by automating notifications, providing structured workflows and reducing the risk of missed deadlines.

Understanding What SEC Incident Reporting Rules Mean in Practice

The SEC’s 48-hour rule for reporting significant incidents is a clear signal: firms need to be ready to detect, assess and act fast. To meet this requirement, firms need:

- Early detection tools that flag incidents as they happen.

- Immediate escalation to compliance and leadership teams.

- Clear documentation of actions taken and messages sent.

- Templates for reporting to speed up submission while keeping messaging accurate.

For example, if a data breach is detected at 10 a.m., an automated workflow can alert IT security, compliance and the executive team within minutes, and prepare a draft notification for the regulator. This kind of structured process can mean the difference between meeting or missing the reporting deadline.

Best Practices for Regulatory Reporting in Investment Management

Strong regulatory reporting processes are not only about meeting legal requirements. They also support operational resilience and investor confidence. Key practices include:

- Centralise incident management to remove delays caused by multiple disconnected tools.

- Standardise reporting templates for key regulations such as SEC, DORA and FCA.

- Keep transparent audit trails for every message and response.

- Run regular drills to keep teams prepared for real events.

- Integrate regulatory reporting software into wider business continuity planning.

- Involve third parties in exercises, since many incidents involve vendors.

- Review performance after incidents to improve processes and close gaps.

These steps make reporting faster, more accurate and easier to demonstrate during regulatory reviews.

How Crises Control Can Help Investment Firms

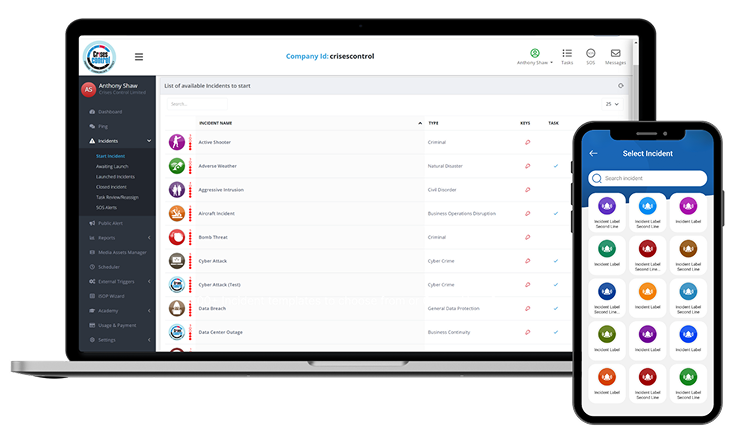

Crises Control provides investment management firms with a platform designed to support regulatory compliance, streamline reporting and strengthen operational resilience. It is more than a messaging tool. It offers a structured and reliable way to manage incidents from start to finish.

Key features include:

- Fast multi-channel alerts through SMS, push notifications through the Mobile App and Microsoft Teams, voice calls and email.

- Automated workflows for escalation and incident coordination.

- Comprehensive audit trails for regulatory reporting.

- Pre-built templates for SEC, DORA and FCA notifications.

- SOS and safety confirmation tools to support staff during emergencies.

- Drill and simulation capabilities to keep teams ready.

- Support for multiple jurisdictions to simplify reporting across regions.

By giving firms a single source of truth, Crises Control helps make incident reporting faster, clearer and more reliable.

Interested in our Incident Management Software?

Launch and manage incidents in seconds with real-time dashboards, task management, multi-channel alerts, and mobile access for seamless response.

Take Control of Your Incident Response and Reporting

Regulatory expectations are getting tighter, and the margin for error is shrinking. Investment firms that rely on manual processes will find it increasingly difficult to keep up with fast reporting deadlines.

A structured platform like Crises Control can help investment management firms meet SEC, DORA and FCA reporting requirements while improving resilience and protecting their reputation.

Take the next step

Book a free demo and see how Crises Control can help your firm respond faster, communicate clearly and meet its regulatory obligations.

Request a FREE Demo