Written by Anneri Fourie | Crises Control Executive

The Communication Gap That’s Putting Insurers at Risk

Insurance firms are under growing pressure to manage emergencies quickly and effectively. The challenge isn’t just the scale or nature of the risks they face, such as cyberattacks or system failures, but how those events are communicated and handled across widely spread teams.

With employees now working from multiple locations, including regional offices, home environments, or even in the field, getting critical information to the right people at the right time is harder than ever. Relying on outdated systems like bulk email chains, WhatsApp groups, or manual phone lists is no longer enough. These methods often lead to confusion, delays, and serious operational consequences.

This blog explores the communication challenges facing insurers and how the right emergency notification system can help bridge the gap. It also shows how Crises Control supports insurance firms with the tools they need to act faster, remain compliant, and protect both their teams and their reputation.

What Happens When Communication Breaks Down?

In a crisis, every minute matters. A slow or disorganised response can have long-term effects, especially for insurers who must meet regulatory requirements while continuing to serve customers.

Here’s what a slow response might look like in practice:

- Teams aren’t informed quickly about a cyber breach, allowing it to spread further.

- Employees working remotely don’t receive evacuation instructions during a fire drill.

- Key staff are unreachable during an IT outage, delaying recovery efforts.

- Documentation required for compliance reviews is incomplete or scattered.

This isn’t just inconvenient. It risks breaching rules under regulatory bodies such as the Financial Conduct Authority (FCA), the EU’s Digital Operational Resilience Act (DORA), and Solvency II. It can also lead to reputational damage and poor outcomes for policyholders.

A dedicated emergency notification system helps prevent this. It allows insurers to deliver urgent messages to everyone affected, on any device, and with full visibility on who has received and responded to those messages.

Reaching Distributed Teams in Real Time

One of the biggest changes in the insurance industry over the past few years has been the shift to flexible, decentralised work models. Many teams are now working remotely or spread across multiple offices and time zones.

Coordinating a quick and effective response across these locations isn’t easy. You can’t rely on people checking their inbox every few minutes or being available for a phone call. When an incident occurs, you need to know that staff will be notified immediately and that they will acknowledge and act on that information.

Crises Control solves this problem with a mobile-first emergency alert system designed to cut through the noise. Messages can be sent by SMS, email, push notification, Microsoft Teams, voice call or even silent alerts. This means employees are contacted through whichever channel they are most likely to see quickly.

The system also provides clear tracking so managers can see who has received and read the message. If there’s no response, it can automatically escalate the alert to someone else. That ensures nothing falls through the cracks.

From Static Plans to Actionable Responses

Many business continuity plans are still stored in PDFs, printed documents or Excel spreadsheets. While these might meet regulatory requirements on paper, they are often difficult to use during a real incident.

In an emergency, there’s no time to dig through files or search for the correct procedure. What you need is a plan that can be activated instantly, with tasks assigned to the right people and progress tracked in real time.

Crises Control helps insurers move away from static documents by offering a business continuity planning tool that brings those plans to life. Once a crisis is identified, the platform allows teams to launch a pre-approved workflow with just one click.

This approach allows for:

- Instant task assignment with automated reminders

- Centralised progress tracking

- Predefined roles and responsibilities

- Reduced reliance on manual coordination

The result is faster action, better coordination, and fewer mistakes during high-pressure situations.

Staying on the Right Side of FCA and DORA Regulations

Insurers are under close scrutiny when it comes to operational resilience. Regulators want clear evidence that firms can continue providing critical services during disruptive events and that they have reliable systems in place for communication and escalation.

The FCA requires that insurance companies show how they identify important business services, map out dependencies, and put in place effective communication systems to manage disruptions. Similar expectations are laid out in DORA and Solvency II, which focus on digital and operational resilience across financial services.

So, what’s the challenge? Many traditional tools don’t provide the audit trails, delivery tracking, or real-time data that compliance teams need.

Crises Control provides several features that help insurers meet these expectations, including:

- Time-stamped logs for every message sent and received

- Staff acknowledgement tracking

- Customisable alert templates to match regulatory procedures

- Secure data storage with controlled access

This not only helps during an audit, but also improves internal accountability and learning after an incident. If you’re asking how notification tools help meet FCA or Solvency II compliance, this is where Crises Control delivers real value.

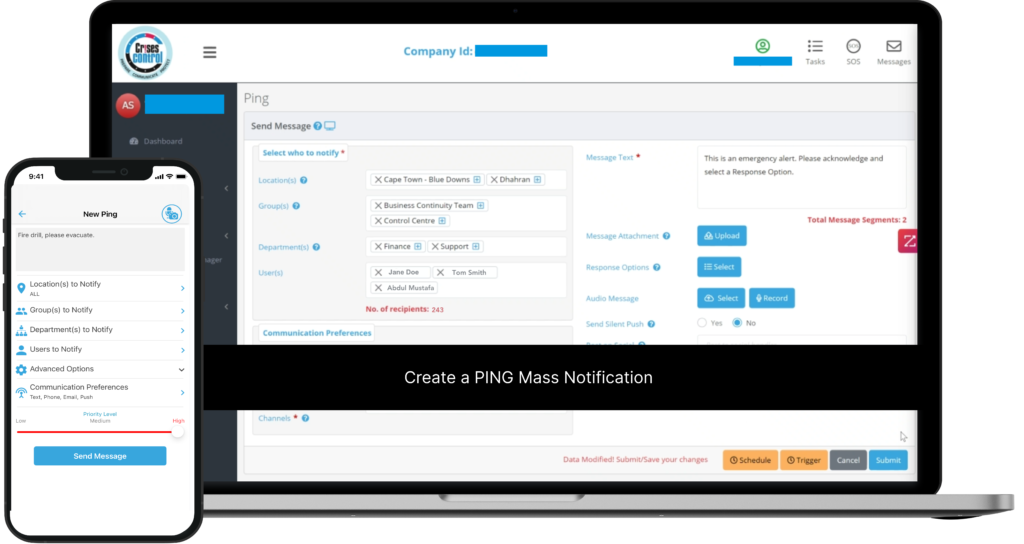

Interested in our Ping Emergency Notification System?

Efficiently alert everyone in seconds at scale with our Emergency Notification System – PING, get the message out fast and ensure rapid response and recovery.

Why Fragmented Tools Cause More Harm Than Good

It’s common for organisations to rely on a mix of tools for internal communication: emails for general updates, messaging apps for urgent issues, spreadsheets for planning, and manual lists for contact details. But during a crisis, this kind of setup can create chaos.

You need a single point of control. Crises Control acts as a central platform that brings everything together: alerts, workflows, contact management, task tracking, and compliance records.

This kind of integration provides real benefits:

- No more switching between apps to issue updates

- Reduced chance of sending incomplete or conflicting messages

- Better oversight of the entire response process

- Easier training and onboarding for staff

By using one platform instead of five or six disconnected tools, insurers can improve both speed and clarity during incidents.

Real Examples from the Insurance Sector

Crises Control is already supporting several insurance firms across the UK and Europe. Here are just a few examples of how the platform has helped improve emergency response and continuity planning:

Cyberattack Response

A large insurer experienced a ransomware attack targeting their customer data. Crises Control enabled their security and IT teams to be alerted within seconds, with response tasks automatically distributed. As a result, they were able to contain the threat quickly and avoid a data breach.

Coordinated Fire Drill Across Offices

A regional insurer with offices in multiple locations used Crises Control to coordinate a fire drill. Alerts were sent to all employees at the same time, responses were tracked, and a report was automatically generated to review performance.

Keeping Remote Teams Informed During Storm Disruption

When extreme weather threatened office access and claim centre operations, Crises Control sent real-time updates to remote staff and field agents. This ensured that claimants continued to receive assistance without delays, even as physical offices were closed.

These are practical, measurable results that show how a tailored emergency notification system for insurers makes a real difference.

What Communication Platforms Are Insurers Using?

While some insurance companies still rely on generic communication tools, more are recognising the value of platforms designed specifically for emergency situations. The most effective platforms offer:

- Multi-channel alerting

- Real-time delivery tracking

- Integration with continuity and incident planning

- Full audit logs for compliance

- Simple interfaces that work across devices

Crises Control offers all of these features and more. Unlike traditional tools, it is built with emergency situations in mind, meaning insurers can act confidently even when the pressure is on.

Final Thoughts: Don’t Let Delays Decide the Outcome

When a crisis hits, your response time can mean the difference between minor disruption and serious consequences. Whether you’re managing a cyberattack, a building evacuation, or a system failure, you need to know that your people will get the right information, quickly, wherever they are.

A reliable emergency notification system is no longer a nice-to-have. For insurers, it’s essential to ensuring continuity, safety, and compliance.

Crises Control helps insurance firms modernise their approach by combining mass notification, business continuity planning, and incident management into a single, easy-to-use platform.

Get a Free Demo of Crises Control

If your organisation is still using manual processes or disconnected tools to handle emergencies, now is the time to improve. See how Crises Control can help your insurance team respond faster, stay compliant, and coordinate better during any incident.

Contact us today to request a free demo and discover how your organisation can benefit.

Request a FREE Demo